The next Bitcoin halving will soon be upon us, and many people expect it to have a positive effect on the Bitcoin price. The fourth such event in Bitcoin’s history, it’s projected to occur in April 2024.

If you’re unsure how halvings work or why they’re significant, you may also be wondering why they’re relevant to price. In this article, we’ll explain what a Bitcoin halving is, and will look at its historical price impact.

What is a Bitcoin Halving?

For every block a miner adds to the blockchain, he or she is rewarded with a certain amount of newly-created Bitcoin. Yet there is also a finite number of Bitcoins that can ever be created. In order to extend the life of Bitcoin and ensure that it remains a deflationary asset, Satoshi Nakamoto wrote into Bitcoin’s code that the supply of new BTC awarded to miners is halved every 210,000 blocks, or roughly every 4 years. For this reason, Bitcoin halvings serve as major milestones in Bitcoin’s timeline, dividing it into distinct periods.

But why does this affect the price? Just as multiplying the available supply of fiat currency has dramatic knock-on effects for a country’s economy, most notably rampant inflation, halving the supply of bitcoin is a major economic change with wide-reaching consequences. Increasing supply has the effect of making fiat money less scarce, thus reducing its value—that’s why prices rise rapidly when inflation is high. Decreasing bitcoin supply increases scarcity, which historically has led to a higher value.

When was the last Bitcoin Halving?

The last Bitcoin Halving took place on May 2020which caused the block reward to fall from 12.5 new Bitcoin created to 6.25 new Bitcoin created. As to be expected, there were large fluctuations in the Bitcoin in the months surrounding this event.

Bitcoin Halving Chart with Dates

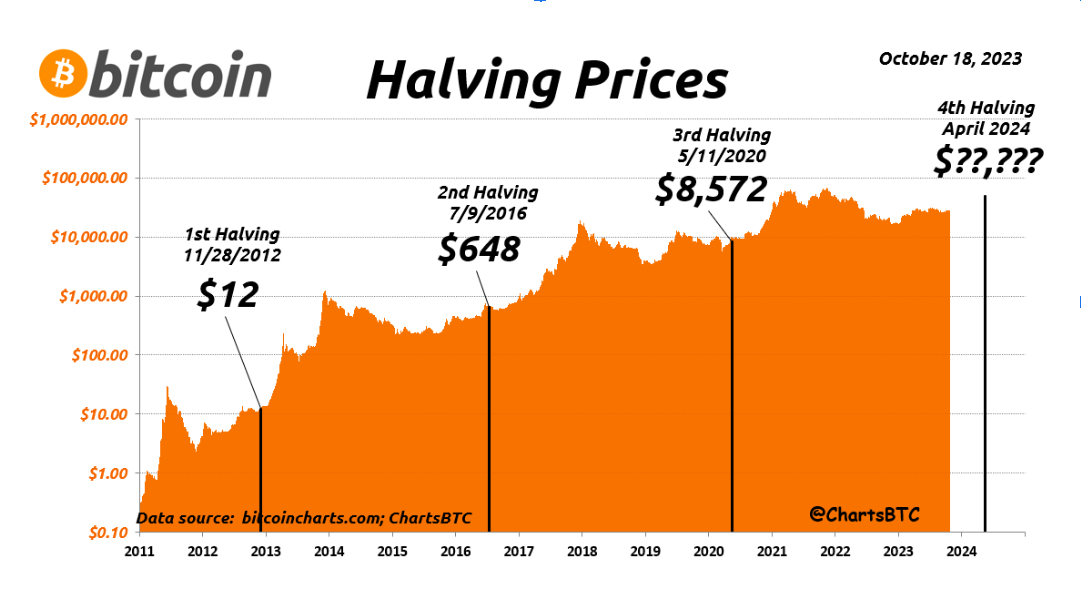

One of the best ways to gauge what effect the new halving will have on price is to look at a price chart with all previous halvings demarcated:

New Project 8

Courtesy of @ChartsBTC on Twitter, this logarithmic chart shows Bitcoin’s price against halvings.

Let’s examine this chart in depth, as it helps to clarify the price effect of previous halvings. We’ll examine each of Bitcoin’s “ages” in turn, starting from the reddish block on the left.

1) Pre-Halving Era

Time Span: January 9th 2009 to November 28th, 2012.

Block Span: 0 to 210,000.

Block Reward: 50 BTC per block mined.

The leftmost block represents Bitcoin’s earliest period, during which time it was largely unknown to the general public. Satoshi set the initial block reward at 50 BTC. Thus, for every block a miner added to the chain, they both earned and created 50 BTC. The result of this high reward was rapid early issuance, with 50% of Bitcoin’s entire total supply (of 21 million BTC) issued during this initial period.

Satoshi personally acquired a large chunk, as he was practically the only miner throughout much of 2009. Outside of technical curiosity, there was little incentive to participate in early mining, as BTC had yet to establish any real value. Only in late 2010, with the emergence of early exchanges, was a price point above $1 established. This demonstration of value soon attracted more miners, ramping up difficulty and driving competition for ever-faster mining hardware and cheaper power.

As awareness of this new technology’s potential began to spread, a credible market value was gradually established, and early adopters realized that Bitcoin had the potential to achieve tremendous growth in the future.

Bitcoin’s abundant early supply was thus soaked up by those with foresight. This led to Bitcoin’s first price spike above $10, as sellers noticed the demand and began demanding a higher price for their coins. A crash followed but recovery was rapid, as the market realized that the halving in late 2012 would offer price support. The pattern of a rising price leading to a halving was established at the end of this era.

2) 1st Halving Era

Time Span: November 28th, 2012 to July 9th, 2016.

Block Span: 210,000 to 420,000.

Block Reward: 25 BTC per block mined.

As 50% of BTC supply was issued during the earliest era, it’s logical that 75% of supply had been issued by the end of this phase. The economic model of supply and demand has it that if supply decreases while demand holds steady or increases, prices must rise. This was proven nicely during Bitcoin’s 2nd era, as the price rose dramatically.

As predicted, decreased supply (and expanding public awareness) led to a higher Bitcoin price during this era. Price peaked explosively above $1,000 in late 2013 before crashing as the leading exchange at the time, Mt. Gox, failed catastrophically. This led to an extended period of decline and stabilization. Significantly, price held above the previous era’s peak, maintaining a bullish chart from a long term perspective.

It’s likely that the prospect of the 2016 halving motivated to resume its upward trend.

3) 2nd Halving Era

Time Span: July 9th, 2016 to May 11, 2020.

Block Span: 420,000 to 630,000.

Block Reward: 12.5 BTC per block mined.

This period saw increased rivalry in the cryptocurrency sphere, especially with the rise of Ethereum as a notable alternative. Additionally, the surge of Initial Coin Offerings (ICOs) played a significant role in inflating the crypto market bubble, which hit its zenith towards the end of 2017 and the beginning of 2018.

One difference to notice from previous eras is that the usual pattern of a steady price rise about a year out from the halving has yet to occur. A possible reason for this is the fallout from the massive PlusToken ponzi scam in China. The fraudsters accumulated a massive $2 billion worth of Bitcoin which, according to blockchain analysis experts, is still being sold off. This major selling volume is reportedly suppressing the price of Bitcoin.

4) 3rd Halving Era

Time Span: May 11, 2020 to April 2024 (expected)

Block Span: 630,000 to 840,000.

Block Reward: 6.25 BTC per block mined.

The third halving era was a real game-changer for Bitcoin, cutting the mining reward down to a mere 6.25 BTC. During this time, Bitcoin showed its strength even as the world faced economic challenges from the COVID-19 pandemic. Its value went up, reaching new highs and earning it the nickname “digital gold” for being a reliable investment during uncertain times.

Bitcoin’s journey reached a remarkable milestone, with its market capitalization exceeding $1 trillion for the first time. This landmark event saw Bitcoin’s value peak at an all-time high of $67,450, capturing the attention of both seasoned investors and a wider audience. The surge in Bitcoin’s price not only highlighted its growing appeal but also marked its entrance into a broader financial conversation, drawing interest from various sectors and reinforcing its position in the investment landscape. This significant achievement underscored Bitcoin’s increasing relevance and potential in the evolving world of finance.

Bitcoin stock to flow model

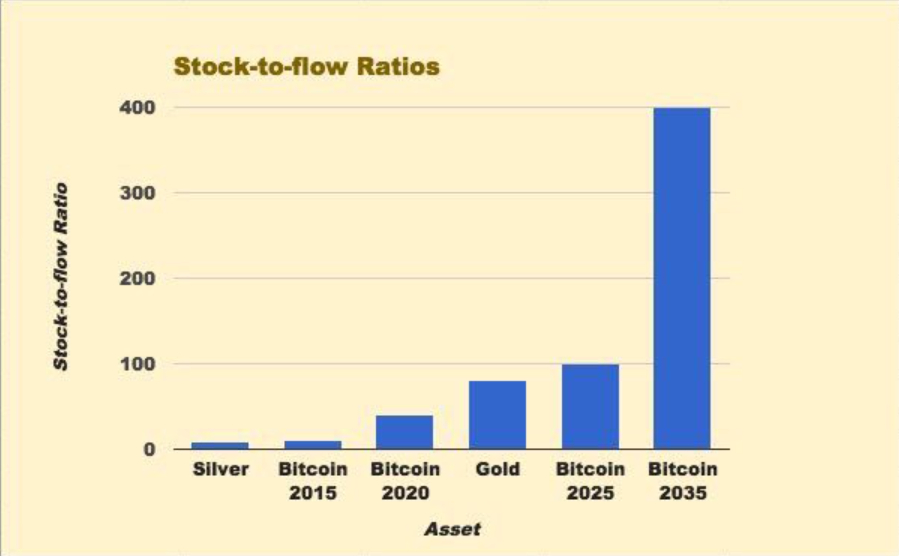

In addition to supply and demand considerations, there’s another popular economic model that has relevance to any discussion of the halving. The Stock-to-Flow Model has recently gained popularity as a means of projecting Bitcoin’s price. This model tracks the ratio between existing supply (stock) and the rate of new issuance (flow). This is essentially another way to measure scarcity.

From Jim Brysland; a comparison of Bitcoin’s Stock to Flow ratio against monetary metals.

The model shows that sometime before 2025, Bitcoin will overtake gold in terms of scarcity value, thus potentially becoming a better store of value than the yellow metal. The increasing ratio is directly related to the reduction of “flow” through the halving mechanism.

The next Bitcoin Halving

The next Bitcoin halving is generating buzz for its potential to significantly impact Bitcoin’s value and the broader crypto market. This event will cut the block reward from 6.25 to 3.125 Bitcoins, reinforcing the concept of Bitcoin’s scarcity and its appeal as a digital store of value. Historically, halvings have led to bullish trends in Bitcoin’s price, and many in the crypto space are eyeing 2024 with high expectations.

With the backdrop of increasing institutional interest and a dynamic regulatory environment, this halving could mark a turning point for Bitcoin’s acceptance and market dynamics. Predictions for post-halving prices range widely, from conservative estimates in the six figures to more optimistic forecasts suggesting unprecedented peaks. As we move closer to the 2024 halving, the crypto community remains watchful, ready to navigate the opportunities and challenges this event may bring. Remember, while predictions provide insight, the crypto market’s volatility calls for careful consideration and due diligence in any investment decisions.

What Does This Mean for You?

Whether you’re a seasoned investor or new to the world of cryptocurrency, the Bitcoin Halving is a pivotal event that offers exciting opportunities. It’s a great time to reassess your crypto strategy and perhaps consider how Bitcoin fits into your portfolio. With Coinmama, you can buy and sell cryptocurrency hassle-free, making it easier for you to explore the opportunities and challenges presented by this event during these times of change.

Stay Informed with Coinmama

If you’re keen on staying updated with the latest in crypto, why not subscribe to our newsletter? We provide regular updates, insights, and tips to help you navigate the ever-evolving world of cryptocurrency.

Remember, while the future of Bitcoin is as exciting as it is unpredictable, Coinmama is here to help you every step of the way. As always, our friendly is ready to assist with any questions or needs