The Bitcoin white paper is entitled “Bitcoin: a Peer to Peer Electronic Cash System.” Satoshi always had good reasons for his decisions, and this title is no exception. Describing Bitcoin as electronic cash, rather than a new payment system, makes a lot of sense. Here are just some of the similarities:

Cash is used in a peer-to-peer fashion which is hard to block or trace, just like Bitcoin.

Cash can also be exchanged without requiring the approval of central authority, just like Bitcoin.

Governments and central banks are seeking to limit and control both cash and Bitcoin, as they prefer forms of money under their complete control.

For both Bitcoin and cash, possession is more than nine-tenths of the law. Unlike electronic money in a bank or payment service, cash and Bitcoin are under the full control of whoever owns the wallet in which they’re stored.

Where Bitcoin and cash differ is that the creation of cash is fully centralized and theoretically unlimited, but we might say that Bitcoin is an evolution of cash which solves those problems.

In this article, we’ll discuss the pros and cons of selling Bitcoin for cash. We’ll also provide some tips on the best ways of doing so.

Briefly, there are two main ways to sell your coins for cash and both take place offline. You can either sell your coins to a person or to a two way Bitcoin ATM (“BTM”), which both buys and sells bitcoins.

The Advantages of Person-to-Person Cash Sales

As discussed in our previous article, How to Sell Bitcoin, cash is the most private method for both buying and selling Bitcoin. There are several reasons for this.

Firstly, person-to-person cash trades are either conducted with a known friend, colleague, or acquaintance or otherwise arranged through a decentralized exchange (or a “dex”). Though this is starting to change, most dexes do not require their users to submit personally-identifying information. Without personal identification, it’s much easier for both parties to retain their financial privacy.

The second reason that these trades are more private is the payment method. Unlike bank transfers, the use of a payment service, or even exchanging vouchers for bitcoin, cash has no linkage to a buyer’s real identity. When someone pays with cash, there’s no definitive record created of who paid whom, when they paid, or how much they paid.

Note however that when conducting such trades via a dex’s escrow service, the dex may record the transaction as having taken place. Although decisive evidence of cash changing hands will be absent, if the dex has also recorded the real identity of the trading parties then not much financial privacy will be gained over non-cash methods.

The upshot of all this is that you can charge more when selling bitcoins for cash to a person. This is because buyers who are concerned with their financial privacy are willing to pay a premium for cash purchases.

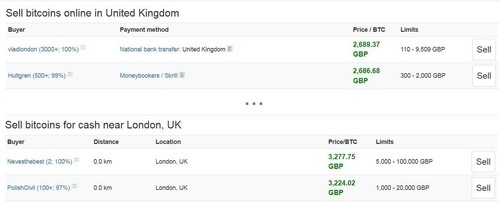

Here’s an example of that price difference from dex buyers in London on the 8th of February 2019:

As you can see, there’s a £588 difference between the best offers from a cash buyer and a bank transfer buyer.

The Disadvantages of Person-to-Person Cash Sales

Before getting too excited about the extra money to be made by selling bitcoins in-person for cash, it’s wise to assess the extra costs and risks associated with this practice. The major cost is time; unlike selling Bitcoin online, which is usually a quick and easy process, in-person cash sales require you to first wait for a buyer to accept your trade and then to set up a meeting. Depending on your location and the logistics, finalizing the trade could take hours or days, or even weeks.

While most Bitcoiners strongly believe that financial privacy is a basic human right, it’s also undeniable that criminals are just as enthusiastic about the subject. It is therefore not beyond the bounds of possibility that the stranger you meet might turn out to be a criminal with the intent to anonymously buy bitcoins to exchange for narcotics on a darknet market. Person-to-person cash sales, therefore, carry a greater risk of criminality.

There have been cases, particularly in the United States, where undercover law enforcement officers met up with Bitcoin sellers. Prior to purchase, these officers disclosed that their intention was to purchase drugs with the BTC – then arrested the sellers when they went ahead with the deal. Whatever you might think of such practices, you should immediately terminate the deal if the buyer mentions any sort of criminal activity, such as drugs or money laundering. If you go ahead with the sale, you might end up in legal difficulties.

There are some further criminal risks associated with in-person sales. There’s a small but real risk that someone might pass you counterfeit bills. There are two ways to deal with this eventuality: either have them withdraw the cash from an ATM or bank teller while you watch, or take along a counterfeit detector. Such devices can be bought for under $100 and should reveal all but the most sophisticated of fake banknotes. It’s best to mention in your sales offer that you scan bills as a part of doing business, as this will discourage counterfeiters and those who might take offense at the practice.

Another criminal risk to watch out for is that someone might trick, rob, or mug you. There have been stories of people who’ve snatched back their money or run off without paying or as soon as a seller sends the coins. For this reason, it’s recommended that you only finalize the sale once the money is in your hand. The buyer will want to see you press the button on your mobile device which releases their coins, so it’s good etiquette to show them this process.

Finally, it’s also possible that someone might threaten you with violence. To avoid such unpleasantness, always meet your buyer – especially a new buyer – in a secure location. Some good places are a bank lobby, police station, inside a courthouse, or in a secure zone within an airport. Anywhere with guards, cameras, metal detectors, and witnesses is a good start as, generally speaking, criminals will be reluctant to meet in such a high-risk (for them!) location.

The Advantages of BTM Cash Sales

Tip: BTMs can be located on the CoinATMradar site.

The strongest advantage of BTMs is that they’re usually available to provide cash at any time, and there’s no need to set up a meeting with another person. Assuming you have a two-way BTM near to you, which isn’t inside a store or mall which closes at night or on holidays, you can get cash for your coins whenever you like. You can identify such BTMs on CoinATMradar by their green “24/7” symbol.

Another plus for BTMs is that they carry less risk than meeting a stranger. You will usually have some legal recourse should the machine defraud you, as the operator’s details are on record with CoinATMradar and presumably with whoever manages the property in which the BTM is located.

That said, you should exercise similar precautions as when using a regular ATM. Although there’s no PIN to guard from prying eyes, you should still be on guard against any suspicious characters after your newly-dispensed cash.

The Disadvantages of BTM Cash Sales

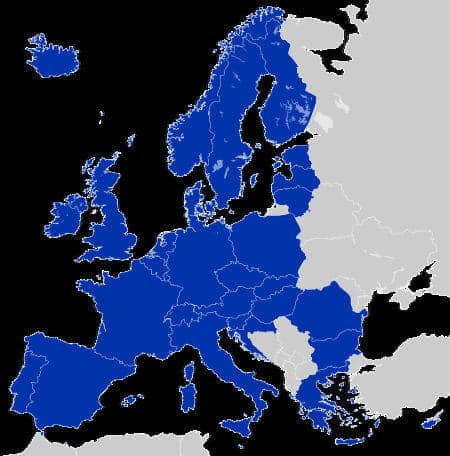

Although BTMs are increasingly common all over the world, ones which allow you to sell bitcoins are rare. Unless you live in a major urban center, you’ll probably not be able to find one within a convenient distance. Contrast the following maps for devices which are buy-only vs. two-way:

Another drawback to BTM sales is that they offer a low price. Often the price is even lower than the standard price you’d get for selling your coins online on a big exchange. BTM operators need to recoup their investment costs so often charge fairly high fees on top of the low rate they offer. A related difficulty is that many BTM operators disable the reporting of their rates and selling limits on the CoinATMradar site, meaning that you can only discover this information by visiting the BTM.

Finally, it should be noted that most BTMs will require some form of identification. You may have to take along an identity document for the device to scan. At an absolute minimum, expect to give the device your phone number.

Other Cash Sale Options

You may also find other options, listed as “tellers” on the CoinATMradar site, close to you. You might even find a local Bureau de Change or money exchanger willing to accept bitcoin. However, these methods suffer from the same identification and low rates disadvantages as BTMs, and are also highly unlikely to operate around the clock.

Coinmama Now Lets You Sell Bitcoin

Coinmama makes it easy to sell your Bitcoins for Euros, sent to any SEPA bank accounts. If you have Bitcoins you’re ready to sell, you can do so through Coinmama for up to €10500 (or $12,000) at a time.

At the moment this option is available for Bitcoin only and in European countries that support SEPA bank transfers, as well as holders of SEPA bank accounts worldwide:

However, we are constantly expanding our reach! In time, we hope to extend this feature to your country too.

Please have your bank details (including IBAN) at hand and your Bitcoin wallet ready for sending before initiating a sale. Once you’re prepared, here’s how to sell your Bitcoin to Coinmama, in 6 easy steps:

Step 1 – Create Your Coinmama Account:

If you don’t already have a Coinmama account, head to the Coinmama website and select the blue “Sign Up” tab.

You’ll need to enter your email, password, first name, last name and your country of residence.

If you already have an account, just sign in via the “Log In” button with your existing login details.

Step 2 – Verify Your Account:

To sell Bitcoins (BTC), you first need to get approved for purchase by verifying your account.

You’ll have to upload your ID or passport, as well as other documents depending on the level of verification.

Step 3 – Initiate the Sale:

Select the “Sell” tab on Coinmama’s homepage option. You’ll need to be logged into your account, and will have to have completed our verification process before creating your first order. If you’re not logged in when you click “Sell,” you’ll be prompted to do so.

Choose how the amount of coin you’d like to sell. Enter the Bitcoin quantity you’d like to sell and the Euro conversion rate will be displayed. Alternately, enter the desired amount of Euros you wish to receive and the correct Bitcoin quantity will be displayed.

Click the “Sell” button to proceed with the trade.

Step 4: Enter Your Bank Account Info

Next, please enter your bank details. Select your bank’s national location and enter your IBAN (International Bank Account Number). You can find your IBAN on your bank statement or by logging into your online banking system. (Caution: the bank account entered must be your own, and must match the name on your Coinmama account. We cannot send Euros to any third-parties or corporate accounts.)

For regulatory purposes, we need you to answer a few questions about yourself and the Bitcoins which you’re selling.

Step 5: Send Your Bitcoins to Coinmama

Now it’s time to send us your coins. Please ensure that you do so within 30 minutes of providing us your bank information in Step 3, otherwise your order will expire.

From your personal Bitcoin wallet, send the agreed-upon amount of Bitcoin to the exact wallet address provided by Coinmama.

Copy and paste Coinmama’s receiving address from our site and into your wallet to avoid any errors. Alternately, you can scan the QR code on the checkout screen from any wallet app with scanning functionality.

Step 6: Wait for Your Euros to Arrive

Once your coins are confirmed on the Blockchain and received by Coinmama, we will transfer the Euro amount to your bank account using a SEPA bank transfer. Keep an eye on your email for a confirmation of the transaction, and expect the funds to arrive within 1 – 2 business days.