***Disclaimer: The article and the content presented in it are for information purposes only. Neither the article nor any content presented in it constitutes investment advice. Investors must only rely on their own examination of the specific investment including the merits and risks involved, and should seek advice from appropriate advisors and counsels with respect to the legal, accounting, tax and other financial and legal ramifications of purchasing cryptocurrency before making any investment decision. ***

Choice

Before learning how to invest in cryptocurrency, the first point to consider is which crypto(s) to invest in. While price and liquidity are obviously important considerations, developer activity (as measured by merged pull requests on GitHub), community engagement (as measured by activity on social media platforms), and public interest (as measured by Google search interest) are also valuable metrics.

The more knowledge you have of the crypto space, the better a coin’s fundamental value proposition can be assessed. If you have no clear idea of how blockchains operate or their suitable applications, consider first investing in your own education. There’s much hype and woo in this space, which can only be overcome through knowledge.

Diversification

While some recommend a “highly diversified” crypto portfolio, this approach is more applicable to traditional securities markets. Unlike stocks from different sectors or different instrument classes (e.g. stocks and bonds), altcoin prices all tend to move in lockstep with the market leader; Bitcoin.

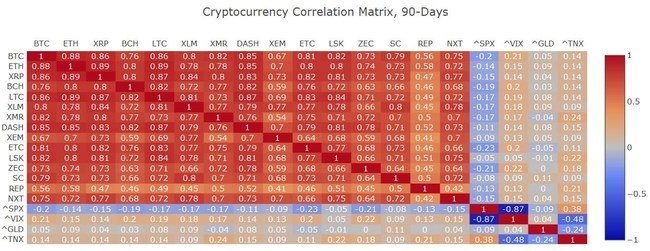

To illustrate, this matrix from Sifr Data shows very high price correlations between Bitcoin and major altcoins over the past few months:

Note that traditional market instruments, such as SPX (S&P 500 index), VIX (S&P 500 volatility) and GLD (gold ETF), all display negative or very low correlations with Bitcoin. This implies that crypto is an excellent instrument for diversification away from traditional markets.

Investing vs. Speculating

While it’s certainly possible to pick altcoins or ICOs which outperform Bitcoin over the short-term, this approach is better suited to aggressive speculators rather than conservative investors. While low-value altcoins have the potential to bring higher percentage gains, they’re also far riskier. A comparison could be drawn between blue chips and penny stocks.

When investing for the long-term, keep in mind that alternative cryptocurrencies lack the longevity implied by Bitcoin’s Lindy effect. Simply put, the fact that Bitcoin’s been around the longest means that it’s likely to last longer. Supporting this assumption is the analysis of network effects, which demonstrates that adoption is central to Bitcoin’s success.

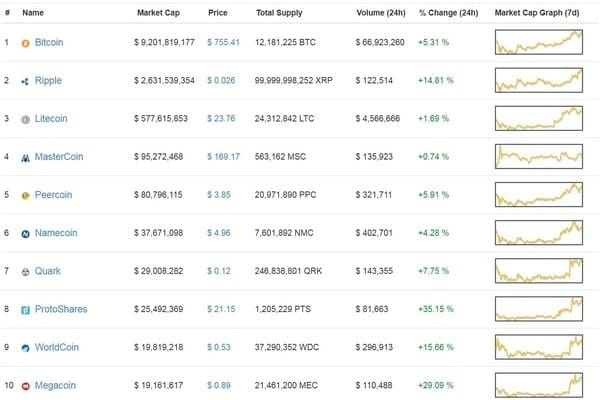

Consider the following list of the top 10 altcoins from 2013:

Only Ripple and Litecoin remain in the current top 10, the others having faded into obscurity. Picking coins for the long haul is no simple matter.

Portfolio Allocation

Given the foregoing, consider a conservative crypto investment portfolio which is predominantly comprised of Bitcoin. The remaining allocation should be devoted to your best choice of coin across the following categories: smart contract platform, anonymity coin, utility coin, and optionally, a coin with high growth potential.

As you’re still learning how to invest in cryptocurrency, you can always buy Bitcoin now and diversify your portfolio later; Bitcoin is often the easiest way to buy other cryptos.

Secure Storage

Consider limiting your investment to those coins which you can easily store in a highly secure manner. Hardware wallets are ideal for secure storage, as they greatly reduce your private key’s attack surface.

Unless your technical expertise is high, paper wallets are not a recommended cold storage solution. They are difficult for non-experts to both create and maintain in a secure manner.

Under no circumstances should you store coins on an exchange or web wallet. History has shown that these online storage methods are prone to failure.

Buy and Hold

Remember that investment is all about buying and holding for the long-term. Only the most major events affecting your personal financial situation or the coins in your portfolio should motivate you to sell prior to reaching your profit target.

There’s a good reason that the hodl meme has caught on among Bitcoiners; over time, the value of BTC has risen. As an investor it’s best to ignore the daily gyrations and avoid hype or panic-based content. Generally speaking, the higher your understanding of crypto the more confidence you’ll have in your investment and its long term value.

Investment Strategy 1: Dollar Cost Averaging

If you’re a relative newcomer to crypto markets, the most reliable and straightforward method to build up an investment position is Dollar Cost Averaging (DCA). This strategy is simplicity itself: use a set amount of fiat to purchase crypto on a regular basis.

The most common purchase frequency is monthly; a portion of one’s salary is set aside for crypto investment.

DCA works because it allows for gradually scaling into a position, without regard for price. This removes all the guesswork from the buying process. Some purchases will prove to be expensive, others cheap, most just mediocre… After practicing DCA for a prolonged period, volume will be accumulated at an average price point – which can be easily calculated by adding all fiat purchase prices and dividing the result by the total number of purchases.

Cryptocurrency is notoriously volatile and unpredictable. Attempting to “go all in” at the perfect price point is likely to result in two outcomes:

- Analysis paralysis, in which little or no crypto is bought but much futile effort is expended in agonizing over price charts, or

- Regret that one either missed the proximate low or bought higher than the current market price… This latter outcome is particularly insidious, as it increases the psychological pressure to sell lower than one bought and so guarantee a loss.

Investment Strategy 2: Buy the Dips

This method is a lot more hands-on and requires market experience, as well as patience!

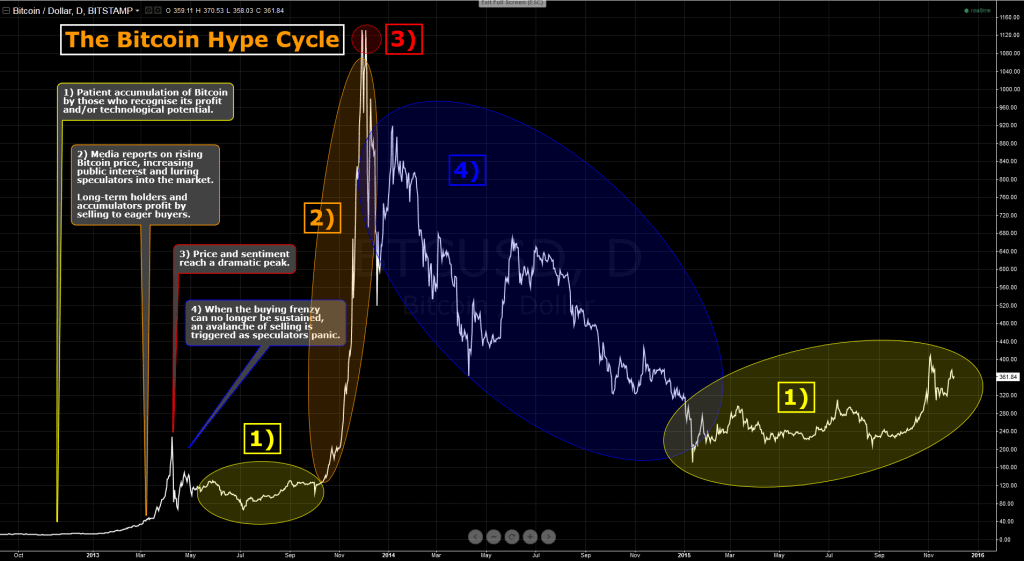

Bitcoin – and other cryptocurrencies by extension – has experienced numerous mania and panic cycles over the years. This cycle is best explained in chart form:

Note how many instances of this cycle have played out over Bitcoin’s entire price history; at least 5 or 6 instances could be cited.

The dip-buying method seeks to exploit this pattern. The aim is to buy as much as possible during phase 1). Optionally, a portion may be sold during phase 3) or 4) in order to bank profits so that more crypto may be accumulated during phase 1).

The primary disadvantage of this method is the necessity of timing, as years may pass between cycles. Furthermore, it can be difficult to distinguish phase 4) from phase 1). Finally, identifying phase 3) is extremely challenging! Crypto manias tend to last longer and go higher than could be reasonably expected. Phase 1) is fairly easy to identify however, as price tends to remain flat for a protracted period.

In addition to market experience, what greatly aids the success of this method is an understanding of the sentiment which drives these cycles. This is often revealed by the tone of media coverage and the aggregate sentiment revealed by social media comments.

Conclusion

This guide covers the basics of how to invest in cryptocurrency. Ultimate success will depend on how well you can apply and extend these ideas. Good luck!