Decentralized Finance – DeFi for short – is a rapidly-growing category in the crypto space that’s getting a lot of attention right now. If you have any interest in cryptocurrency or finance, you’ve probably heard the term DeFi bandied about and wondered about its meaning…

In this article, we’ll explain DeFi in straightforward terms before addressing its pros and cons, estimating its market impact, discussing some of the more prominent examples. Finally, we’ll consider whether DeFi is, was, or will be another crypto-related bubble.

Like the previous ICO phenomenon, DeFi projects are also based primarily on the Ethereum (ETH) platform. Therefore, the overall performance of the DeFi space is sure to affect the value of your ETH holdings (and potentially, the value of the entire crypto space), even if you’re not directly involved in any DeFi projects. It’s also worth noting that the popularity of DeFi projects has consumed much of Ethereum’s network capacity, driving up transaction fees to nearly 5x the average Bitcoin fee.

What is DeFi?

Essentially, DeFi is the recreation of traditional financial services on the blockchain. For example, you could borrow fiat money from a bank or, via DeFi, borrow cryptocurrency from an application running on a blockchain (known as a “smart contract”). Other examples of traditional financial services reworked into the DeFi environment include lending, trading, investing, and insurance.

So, if DeFi is really just providing the same types of services as the banks, brokers, insurers and other financial institutions we’re all familiar with, how is it useful?

While there are certain theoretical advantages related to the decentralized nature of the blockchain and the transparency of open source code, for the average person it comes down to simple 2 reasons…

DeFi’s Advantages

Like we mentioned, DeFi has two major benefits over conventional finance:

Firstly, you’re likely to get a better interest rate from a DeFi contract than from a traditional financial institutions. So, by lending out your crypto coins via DeFi platforms, you can earn far more interest on your savings than you’d get from a bank. In these challenging economic times, better interest rates can be a big deal!

If you’re good with numbers and trading, it’s also possible to participate in so-called DeFi Yield Farming. Essentially, this process involves borrowing tokens which you can then lend out in order to earn more interest than you pay on the initial loan. It can get rather complex and certainly carries substantial risks, but it’s another proven way of making profit within the crypto space.

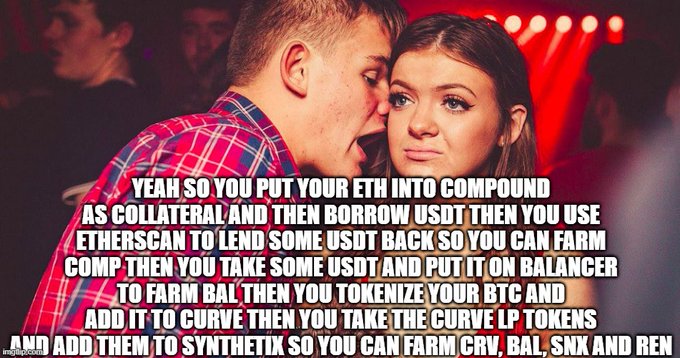

Anthony Sassano tweeted this representation of his efforts to explain yield farming to his fiance.

Secondly, DeFi tends to be a lot more accessible, at least if you can overcome the initial technical hurdle presented by cryptocurrency usage. One of the problems with the current economy is that it’s difficult to get a loan from the bank (unless you can prove you don’t really need the money, as the old joke goes). With DeFi, loans are easy to access, provided you have crypto to lock up as collateral. Even better,

Your age, credit rating, or location in the world won’t prevent you from accessing such financial services, which is often not the case with traditional financial institutions.

Furthermore, the DeFi user experience is likely to be more streamlined (assuming your proficiency with crypto) as DeFi transactions are conducted exclusively via your PC or smartphone, with no need for in-person meetings, document signatures, and the like. So long as you’re able to acquire a cryptocurrency like ETH and perform basic to intermediate functions with it, you’ll most likely be able to access necessary financial services via DeFi.

Like cryptocurrency in general, the popularization of the DeFi concept is likely to spur development of permissionless financial innovation. It’s hard to estimate the potential impact on the world but we expect the DeFi wave to introduce at least a handful of useful innovations which stand the test of time.

DeFi’s Disadvantages

We’ve already mentioned DeFi’s main advantages; profitability and accessibility. However, we also pointed out that profitability depends on you having crypto to lock up as collateral in most cases. Usually a bank will give you a loan if you have a good credit rating and the ability to repay, whereas any lending done in the DeFi space is secured, meaning you can only borrow against crypto you put up as security.

As for accessibility, that depends on your understanding of cryptocurrencies and finance. The further down the DeFi rabbit hole you go, the more specialized knowledge you’ll need to properly assess risks and identify opportunities. For example, anyone making a large investment into a particular smart contract would be advised to thoroughly audit its code to ensure its secure, or pay an expert to audit it for you. This brings us to another obvious problem with DeFi…

DeFi is new and unproven. There have been flaws in the code and design of projects which have led to major loss of funds, either through failure or exploitation. In the 2nd quarter of 2020, over $25 million was stolen from DeFi projects in 3 separate hacks. If you were around for the ICO mania, you’ll remember that multiple projects got hacked or broken due to hastily-constructed code. The lesson is that enthusiasm for the possibilities and profits afforded by novel methods can often outpace technical competence and responsible risk management.

A recent example would be the YAM yield farming project, whose un-audited code experienced a fatal bug which permanently locked up around $750k in user funds.

Significant DeFi Projects

One of the leading sites to monitor all relevant projects is DeFiPulse.com, although their inclusion of Bitcoin’s Lightning Network in the DeFi category is questionable. Interestingly, Bitcoin locked into the WBTC DeFi smart contract has seen higher transaction volume recently than real Bitcoin transferred over Lightning.

The current DeFi leaders as measured by value invested are:

- Maker, a platform which runs the US Dollar-pegged stablecoin, DAI. Makers allows users to lock up crypto collateral to receive loans of DAI. DAI can also be invested into Maker to earn interest.

- Compound, a platform for borrowing and lending at interest. As with Maker and many other DeFi projects, it’s development is governed by holders of its token.

- Synthetix, a platform which essentially allows for the creation of tokens tied to the value of other assets, such as gold or Bitcoin.

New projects are popping up all the time and investigation will reveal that tremendous price volatility exists in this space at present.

Is DeFi a Bubble?

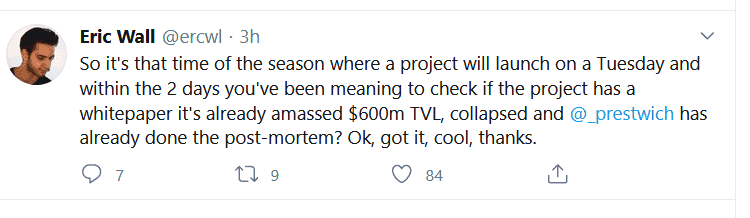

The $5 billion question… There are certain signs that the DeFi space is getting frothy, if not in an actual bubble. For example, Eric Wall recently tweeted a pithy summary of the events surrounding Yam:

This rapid sequence of massive investment and failure is reminiscent of the excesses of the ICO mania. Another worrying sign is that well-known shills, such as Trevon James, who promoted various scams including the notorious BitConnect, has recently started pushing DeFi-related content:

This kind of shallow “easy money” content tends to appeal only to the financially unsophisticated. If you see such “advice” gaining popularity, that’s probably a good social cue that “dumb money” is piling into DeFi.

However, bubbles tend to be clearly identifiable only in hindsight. Yes, there’s a degree of irrational exuberance surrounding DeFi at present, which any potential investor would do well to filter out, but that doesn’t mean that DeFi projects or the overall space has reached peak popularity. Indeed, if this is a bubble then it’s likely just entered its rapid growth phase, as awareness of “easy gains” is only starting to percolate through the mainstream. With many people out of work and desperate for money due to the Covid 19 pandemic, this is precisely the time when a massive bubble could develop in a sector promising large and fast returns…

Investing in Ethereum is a good way to gain exposure to the popularity of DeFi, without directly investing in complex DeFi projects locking money into potentially unsafe smart contracts. However, this is a play only for those with a high risk appetite as, in Kenny Roger’s immortal words, you really have to know when to hold ‘em and when to fold ‘em.

Disclaimer

We’d like to point out that this article should not be construed as financial advice or a recommendation for any particular investments. If you have an interest in DeFi, this article should serve only as a starting point for your own research. Always ensure that you understand all the risks associated with any financial decision and, most important of all, never invest more than you can afford to lose.