Few people enjoy paying taxes. This is especially true of those libertarians and crypto-anarchists who were some of the earliest adopters of Bitcoin. In their view, states had no involvement with the creation, development, or maintenance of Bitcoin, and therefore have little right to tax it.

Indeed, most states have done nothing to support Bitcoin and many have actively opposed it; either through outright bans or by discouraging its use in more subtle ways. That many governments are now applying taxes to Bitcoin may be perceived as somewhat hypocritical.

Still, these emerging taxation policies can also be interpreted as a sign of Bitcoin’s success, or at least its ineradicability. Rather than resisting Bitcoin, many governments are now trying to profit from it instead. There are some definite parallels to the legalization of cannabis, which is occurring in several countries.

The fact is that governments will attempt to tax Bitcoin whether we like it or not. However, creating laws does not guarantee compliance. According to a report published by Reuters in February of 2018, only a tiny percentage of Americans are declaring their cryptocurrency transactions to the tax authorities.

The taxation of Bitcoin transactions is much like the taxation of cash trades. The government expects people to report it, punishes them if they don’t, but has a difficult time tracking their activity… As governments apply stricter rules and find more efficient tracking methods, it may become much harder to avoid crypto taxes in future.

To Report or Not to Report?

For now, in most cases the individual still has the power to decide whether to report crypto trades or not.

1) Reporting Crypto Activity

Reporting is likely to prove a troublesome process for various reasons, such as:

- the exceptional volatility of crypto prices,

- the lack of established and straightforward reporting procedures,

- the burden and difficulty of keeping meticulous records of trading or transactional activity, and

- the inherent complexity and novelty of crypto assets. For example, how should one approach (un)claimed forkcoins or income from mining, staking, or running a master node?

On the positive side, apps (such as BitcoinTaxes or BitTaxer) and advisors are available to make crypto tax reporting that much easier. Check out the Bitcoin Taxes and CryptoTax sub-reddits to make enquiries or discover further helpful apps. Do be careful of relying on advice from internet strangers however; a tax professional in your home country will be the most authoritative source of information.

Furthermore, reporting crypto activity may even prove financially beneficial, depending on market conditions. Under certain country’s tax regimes, crypto losses are deductible against your overall tax bill.

2) Not Reporting Crypto Activity

Not reporting carries some significant risk; chiefly that one may be prosecuted for tax evasion.

While it’s possible to minimize such risks by operating anonymously, conducting business in such a fashion quickly becomes highly inconvenient, even restrictive. The primary difficulty is that exchanging between crypto and fiat becomes problematic. Practically all fiat-supporting crypto exchanges now require verification of a customer’s identity. Following a clear precedent, it should be assumed that exchanges will turn over their records to tax authorities if so ordered.

While you may get away with not reporting fiat-crypto exchanges at this time, remember that such financial records – very much including the indelible public record which is the blockchain – will be around for a long time, even forever. It’s always possible that the authorities will investigate your history, especially if you attract attention by leading a suspiciously-lavish lifestyle.

Keeping fiat-crypto transactions private will require access to the OTC (Over The Counter) market or the execution cash trades via decentralized exchanges. These methods add time and monetary costs, in addition to other risks. To keep legal risks to a minimum, it may be easier to simply render unto Caesar.

How Bitcoin is Taxed

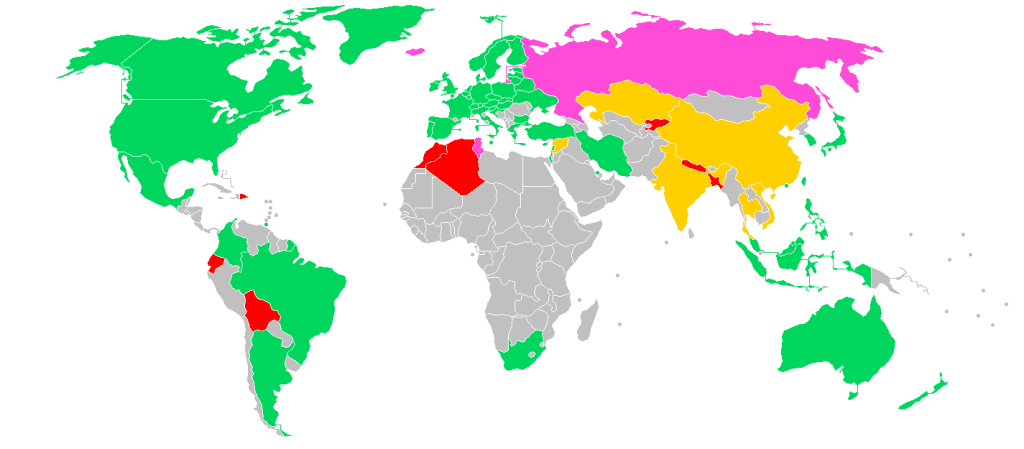

Often Bitcoin’s official classification within a country will determine how it is taxed. The following Wikipedia page should prove helpful in determining Bitcoin’s classification and legal status in your country. If your country has yet to pass taxation laws specifically for Bitcoin and crypto, expect it to be taxed according to its official designation (if any).

Bitcoin is legal in the green countries, of indeterminate legal status in pink countries,

prohibited in most circumstances in orange countries, and entirely prohibited in red countries.

Most commonly, Bitcoin is taxed under existing Capital Gains tax laws. In other words, if you buy BTC and later sell it at a profit, you’re likely to be taxed on the proceeds. Such laws generally apply only when your cumulative profits (usually including income) for the tax year exceed a certain threshold.

Another existing taxation law which is regularly applied to Bitcoin is Income Tax. Workers and freelancers earning Bitcoin are likely to be liable for taxation under such laws, again depending on whether their total income exceeds a certain threshold. Often different brackets or tiers are applied under Income Tax regimes, with higher income attracting higher taxes. Traders should investigate whether they will be taxed under Capital Gains or Income Tax laws, and perhaps consider whether to adjust their trading style accordingly.

The International Tax Situation

At the recent G20 summit held in Argentina in late November 2018, the member nations decided to pursue further regulation of cryptocurrency. Discussion was also held on tightening up crypto taxation, with international cooperation and various policy responses mentioned as methods to extract more tax money from the digital economy.

Despite such talk, at the current time governments around the world handle the taxation (and regulation) of Bitcoin very differently.

In most countries, you will only be taxed on cryptocurrency which you earn or sell for a profit. Certain countries do however impose a tax on each and every crypto transaction, which demands a lot of burdensome busywork. Reform can be hoped for, as both Australia and Poland have reversed their more draconian Bitcoin tax policies.

As for the degree to which Bitcoin is taxed around the world; some countries apply minimal or even zero taxes to cryptocurrency, others impose heavy taxes. Generally speaking, those countries regarded as tax havens (such as island and emerging market nations eager for foreign investment) will tax Bitcoin lightly.

Countries known for high or strict taxation (such as the United States, one of only two nations in the world to tax expats) tend to impose heavier taxes on Bitcoin. There are some surprising exceptions to this rule of thumb however. For example, Germany and Switzerland are two countries with high tax rates, which nevertheless apply only light taxes to Bitcoin profits.

Conclusion

We hope this primer has given you some pointers on how to tackle the tricky matter of Bitcoin taxation. In a series of upcoming articles, Coinmama will explore the Bitcoin tax situation as it pertains to several specific countries, beginning with the UK, Australia, Canada, and the USA.