Barter, Beads, Bullion and Banks: The Four Eras of Pre-Bitcoin Money

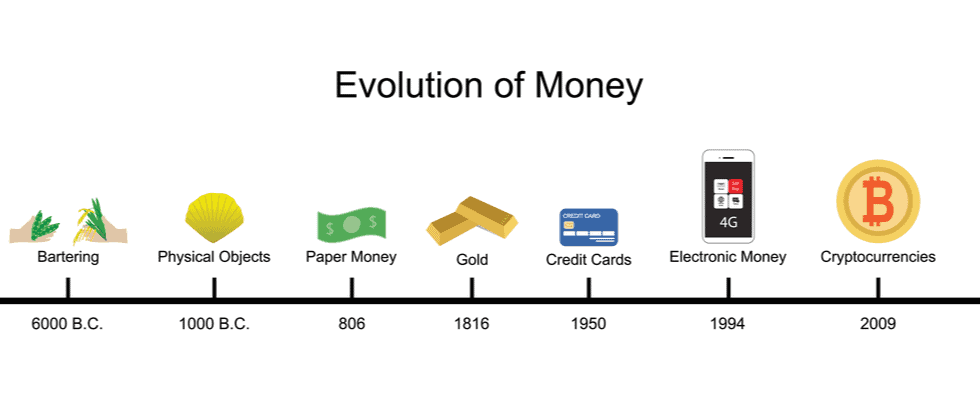

The story about how we got here in the first place begins in prehistoric times. Back then people relied on barter to conduct their business. A tribe specializing in wooly mammoth fur, for example, could exchange said fur for berries gathered by a neighboring tribe. But this system ran into a problem known as the “double coincidence of wants.” That is, in order to complete a transaction, both tribes needed to have something that the other desired. In the summer months, no one wanted woolly mammoth fur, so the unfortunate mammoth hunter would have to forgo his berry snack. Shells, beads, and other collectibles eventually filled the void, serving as representations of value through which tribes could transfer wealth. (For an excellent review of the origins of money, check out Nick Szabo’s groundbreaking article). Obviously, these are too flimsy to form the bedrock of a solid monetary system, and so humanity needed to seek alternative solutions. Enter gold. Humanity’s love affair with gold dates back to the Pharaohs of Ancient Egypt. This shiny, lustrous metal began to captivate the imagination of the human race and quickly rose to prominence as the preferred store of value. Gold, and its less illustrious cousin silver, dominated much of civilization for millennia in both bullion form and as minted coins. Some of the qualities that make gold such an attractive form of money include:- Durability: Gold doesn’t corrode easily.

- Scarcity: The limitations of supply and the difficulty of extracting gold from the earth give it unmistakable value.

- Utility: Makes for beautiful jewelry.

Despite continuing to enjoy immense popularity, gold would eventually make way for paper money and bank-controlled fiat. It started when goldsmiths began to issue notes representing gold held in a vault on behalf of their clients. Nation-states soon realized the power inherent in money printing and began to outlaw this activity. Instead, nation-states created the concept of a central bank that would have the sole right to issue banknotes pegged to the value of gold. In 1944, the post-war Bretton Woods system set out the terms by which every national currency would be pegged to the dollar, which would, in turn, be backed by gold at a rate of $35/oz. However, inflation of the dollar supply led to the collapse of the Bretton Woods model as other countries began to lose trust in the American-led system. But that too would not last. Facing a run on the US gold reserves, Richard Nixon finally decided to unpeg the dollar from gold in 1971. This move, known as the Nixon shock, meant that the dollar was now a pure fiat currency, backed by nothing and controlled entirely by the Federal Reserve. Since then, the Fed and other central banks have had the power to print as much money as they want. This, unsurprisingly, has had a dramatic impact on inflation. Monetary expansion has caused the dollar to lose 85% of its purchasing power since the Nixon shock. And that’s only according to the official statistics. Looking at the Big Mac Index, which tracks the price of Big Macs in various countries, the inflation rate over the last 20 years has been a cumulative 129%. Comparing this with the official rate of 50.75% over the same period suggests that the real effects of inflation are severely underestimated.

Despite continuing to enjoy immense popularity, gold would eventually make way for paper money and bank-controlled fiat. It started when goldsmiths began to issue notes representing gold held in a vault on behalf of their clients. Nation-states soon realized the power inherent in money printing and began to outlaw this activity. Instead, nation-states created the concept of a central bank that would have the sole right to issue banknotes pegged to the value of gold. In 1944, the post-war Bretton Woods system set out the terms by which every national currency would be pegged to the dollar, which would, in turn, be backed by gold at a rate of $35/oz. However, inflation of the dollar supply led to the collapse of the Bretton Woods model as other countries began to lose trust in the American-led system. But that too would not last. Facing a run on the US gold reserves, Richard Nixon finally decided to unpeg the dollar from gold in 1971. This move, known as the Nixon shock, meant that the dollar was now a pure fiat currency, backed by nothing and controlled entirely by the Federal Reserve. Since then, the Fed and other central banks have had the power to print as much money as they want. This, unsurprisingly, has had a dramatic impact on inflation. Monetary expansion has caused the dollar to lose 85% of its purchasing power since the Nixon shock. And that’s only according to the official statistics. Looking at the Big Mac Index, which tracks the price of Big Macs in various countries, the inflation rate over the last 20 years has been a cumulative 129%. Comparing this with the official rate of 50.75% over the same period suggests that the real effects of inflation are severely underestimated.

Are you hungry? A Big Mac costs more than double what it did 20 years ago.

Insightful Queries: Unraveling the Nuances of Money’s Evolution

1. Why did gold become a preferred form of money over other materials?

Gold became a preferred form of money because it is durable (doesn’t corrode easily), scarce (limited supply and difficult to extract), and has utility (can be made into beautiful jewelry). These qualities established gold as a reliable store of value over millennia.

2. What led to the abandonment of the gold standard in 1971?

The abandonment of the gold standard, known as the Nixon shock, occurred when the U.S. unpegged the dollar from gold. This was a response to a run on U.S. gold reserves and marked a shift to fiat currency, where the dollar’s value wasn’t backed by a physical commodity, leading to increased control over monetary policy and significant inflationary impacts.

3. How does Bitcoin improve upon traditional forms of money like gold?

Bitcoin improves upon traditional forms like gold by offering greater scarcity (with a capped supply), digital portability, and decentralization. Unlike gold, Bitcoin can be easily transferred across borders without physical limitations, and its blockchain technology ensures a transparent, secure, and tamper-proof transaction system.